Off-road diesel and regular diesel differ mainly in their uses, taxation, and appearance. Off-road diesel is dyed red, tax-exempt, and lower in price, making it about 25 cents cheaper per gallon. It's intended for non-road applications like agriculture and construction, while regular diesel is clear, taxed, and available at gas stations for on-road vehicles. Both fuels must meet Ultra Low Sulfur Diesel (ULSD) standards, ensuring cleaner emissions. Though they're chemically the same, it's essential to use them correctly to avoid hefty fines. If you want to understand more about these fuels, there's plenty more to explore.

Key Takeaways

- Off-road diesel is dyed red and tax-exempt, while regular diesel is clear and subject to federal and state taxes.

- Both types of diesel meet Ultra Low Sulfur Diesel (ULSD) standards, ensuring cleaner combustion and reduced emissions.

- Off-road diesel is cheaper by approximately 25 cents per gallon, providing cost savings for agricultural and construction industries.

- Misusing off-road diesel in on-road vehicles can lead to substantial fines, emphasizing the importance of compliance with regulations.

- Both fuels are chemically identical, offering similar performance, fuel mileage, and engine efficiency when used appropriately.

Overview of Diesel Fuel Types

When it comes to diesel fuel, you'll encounter two main types: on-road and off-road diesel. Both types are chemically identical, meeting Ultra Low Sulfur Diesel (ULSD) specifications with a maximum sulfur content of 15 parts per million (ppm).

However, their uses and pricing differ considerably. On-road diesel, which is clear, is available at gas stations and is subject to federal and state taxes. This tax burden makes it more expensive compared to off-road diesel, which can be around 25 cents cheaper per gallon due to its tax-exempt status.

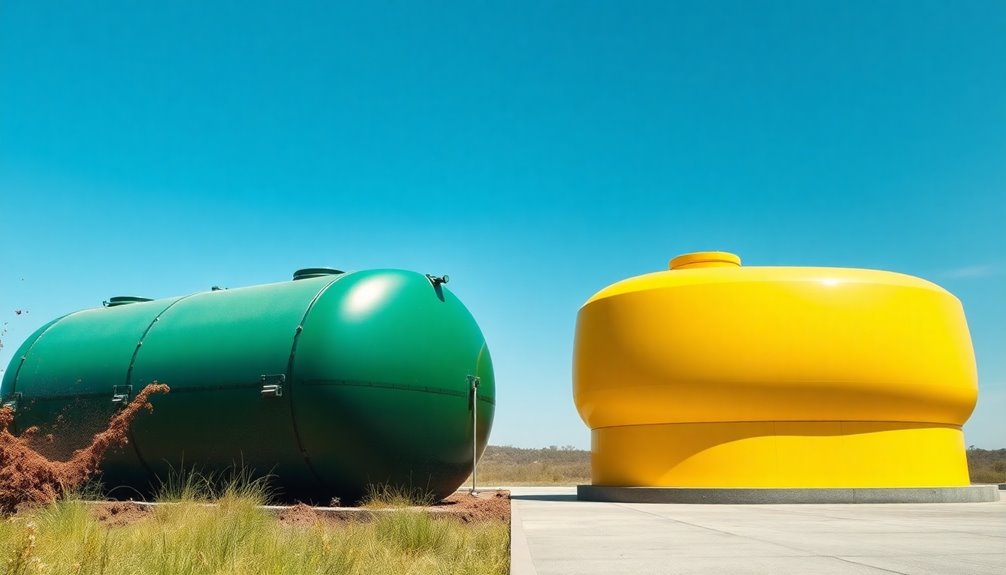

Off-road diesel, dyed red to signify its tax-exempt status, is specifically designated for non-road applications, such as agricultural use, industrial, and construction equipment. This distinct coloration serves as a regulatory measure to prevent misuse in on-road vehicles, which can lead to hefty fines.

Knowing the difference between these two types of diesel fuel is essential, especially if you're involved in fields like farming or construction where cost savings and compliance with regulations matter. Understanding these distinctions helps you choose the right diesel fuel for your needs while avoiding unnecessary expenses.

On-Road Diesel Explained

On-road diesel, often referred to as clear diesel, is specifically formulated for vehicles that operate on public roads. This fuel is available at gas stations and is subject to strict environmental standards and taxes, which makes it more expensive than off-road diesel. You'll find that on-road diesel must meet stringent emission standards set by federal and state regulations, particularly concerning sulfur content.

To help clarify the differences in diesel fuel uses, here's a quick comparison:

| Feature | On-Road Diesel | Off-Road Diesel |

|---|---|---|

| Appearance | Clear or slightly green | Dyed red |

| Usage | Public roadways | Non-public areas |

| Taxation | Subject to highway taxes | Tax-exempt |

All licensed vehicles in the U.S. must use on-road diesel for operation on public roadways to guarantee compliance with legal and environmental standards. By choosing clear diesel, you're not only adhering to regulations but also supporting cleaner air initiatives. Understanding these distinctions can help you make informed decisions about diesel fuel uses for your vehicle.

Off-Road Diesel Characteristics

When you look at off-road diesel, you'll notice several key characteristics that set it apart from regular diesel.

The chemical composition, color markings, and tax implications all play significant roles in its use and regulation.

Understanding these differences can help you make informed decisions about which fuel to use for your equipment.

Chemical Composition Differences

Off-road diesel and regular diesel are chemically identical, both conforming to Ultra Low Sulfur Diesel (ULSD) standards that limit sulfur content to just 15 parts per million (ppm). This means that when it comes to the fundamental components of these diesel fuels, they share the same properties.

However, there are some key distinctions worth noting:

- Tax Status: Off-road diesel is dyed red to indicate its tax-exempt status for non-road applications.

- Usage: It's specifically designated for off-road equipment like agricultural, industrial, and construction machinery, while regular diesel is meant for vehicles on public roadways.

- Historical Context: Before 2014, off-road diesel had higher sulfur levels (up to 500 ppm).

- Cold Weather Performance: Off-road diesel may gel in cold temperatures without proper treatment, a concern that doesn't typically affect regular diesel.

Despite these differences, off-road diesel and regular diesel share similar chemical compositions, both adhering to ultra low sulfur specifications.

Color and Markings

One key characteristic that sets off-road diesel apart is its distinctive red color, which serves as a visual cue for its tax-exempt status. This dyed diesel helps authorities quickly identify whether the fuel is being used illegally in on-road vehicles. The red dye, typically Solvent Red 26 or Solvent Red 164, is essential for guaranteeing compliance with fuel specifications.

Here's a quick comparison of the color and markings:

| Diesel Type | Color | Purpose |

|---|---|---|

| Off-Road Diesel | Red | Tax-exempt for non-road use |

| On-Road Diesel | Clear/Green | Taxed for highway use |

| Dyed Diesel | Red | Identifies improper use |

During a visual inspection, the blood-red tint of off-road diesel sets it apart from regular on-road diesel. It's important to note that if red dye is detected in on-road vehicles, it could lead to hefty fines—up to $10,000—making it critical for operators to understand the color and markings associated with each fuel type. Knowing these differences can help you avoid costly mistakes and guarantee compliance with regulations.

Tax Implications and Regulations

Understanding the tax implications and regulations surrounding off-road diesel is essential for anyone using this fuel type. Off-road diesel, often called dyed diesel or red diesel, is exempt from federal and state fuel taxes, making it about 25 cents cheaper per gallon than on-road diesel fuel.

However, misuse of off-road diesel can lead to severe penalties.

Here are four key points to remember:

- Legal Use: Off-road diesel is only permitted for agricultural, industrial, and construction machinery.

- Fines for Misuse: Using off-road diesel in on-road vehicles can result in fines up to $10,000.

- Regulatory Compliance: Since June 2010, all diesel fuels, including off-road diesel, must meet Ultra Low Sulfur Diesel (ULSD) standards.

- Inspections: Tax authorities routinely check for the red dye in off-road diesel to enforce regulations, using methods like fuel sampling and black light detection.

Stay informed about these regulations to avoid costly mistakes and guarantee you're using off-road diesel correctly. Ignoring these rules can lead to significant financial repercussions and legal issues.

Taxation and Pricing Differences

When it comes to taxation and pricing differences, off-road diesel stands out as a cost-effective option for industries that rely on heavy machinery. Unlike on-road diesel, which is fully taxed, off-road diesel is nontaxed, making it approximately 25 cents cheaper per gallon. This price advantage is particularly beneficial for sectors like agriculture and construction, where every penny counts.

However, it's essential to remember the regulations surrounding off-road diesel. While its lower pricing is attractive, misuse in on-road vehicles can lead to significant penalties, with fines reaching up to $10,000 in states like Oregon. This strict enforcement guarantees that off-road diesel remains designated solely for off-road use, maintaining compliance with regulatory standards.

Furthermore, while federal tax rates on on-road diesel are consistent across the U.S., individual states may impose different tax rates, further influencing the overall pricing.

The fuel quality of off-road diesel is comparable to that of on-road diesel, but the financial benefits of using nontaxed fuel can greatly enhance your operational efficiency. Always keep these taxation differences in mind to maximize savings and avoid potential legal issues.

Intended Use and Regulations

Off-road diesel is specifically meant for agricultural, industrial, and construction machinery, so using it in vehicles that travel on public roads can lead to severe penalties. The regulations surrounding off-road diesel are strict, and it's vital to understand their intended use.

Here are some key points to keep in mind:

- Taxed Status: Off-road diesel is untaxed, making it cheaper than regular diesel, but this comes with restrictions.

- Compliance: Using off-road diesel in on-road vehicles can result in fines of up to $10,000, emphasizing the need for adherence to regulations.

- Emissions Standards: Since 2014, off-road diesel has improved to reduce exhaust emissions by up to 90%, aligning with stricter emissions standards.

- Intended Use: Only use off-road diesel in machinery designed for it; misuse can lead to legal consequences and environmental concerns.

Understanding these regulations will help you avoid costly mistakes and guarantee that you're using fuel in the manner intended.

Always remember that while both off-road and regular diesel meet quality standards, their applications are distinctly different.

Comparisons of Performance and Quality

In comparing performance and quality, you'll find that both off-road diesel and regular diesel are chemically identical, meeting the same Ultra Low Sulfur Diesel (ULSD) specifications. Since 2014, they've adhered to a maximum sulfur content of 15 ppm, guaranteeing cleaner combustion.

Users often report no significant difference in fuel mileage or engine efficiency between the two types of diesel.

While off-road diesel historically had higher sulfur content, modern ULSD regulations have minimized this advantage. However, it's important to recognize that fuel quality can still be compromised by issues like contamination from algae and sediment. This underlines the necessity for regular tank maintenance, which applies to both off-road and regular diesel.

If you're using modern engines equipped with sensors designed for on-road diesel, be cautious with off-road diesel. It mightn't deliver the same performance due to differences in formulation, potentially affecting engine efficiency.

Ultimately, while the two fuels are similar, your choice should consider the specific demands of your equipment and the importance of proper maintenance to guarantee peak performance.

Industry Implications and Benefits

When you choose off-road diesel, you're not just saving about 25 cents per gallon; you're also easing your tax burden, which can free up funds for other operational costs.

However, it's essential to stay compliant with regulations to avoid hefty fines for improper use.

Understanding these implications can help you make informed decisions that benefit your business.

Cost Savings for Industries

Industries that rely heavily on fuel consumption can experience substantial savings by switching to off-road diesel. This alternative fuel is approximately 25 cents cheaper per gallon than regular diesel, which can lead to significant cost savings for your business.

Additionally, off-road diesel is exempt from state and federal fuel taxes, further reducing your operational expenses.

Here are four key benefits of using off-road diesel:

- Lower Fuel Costs: Enjoy reduced fuel expenses, boosting your profit margins in competitive markets.

- Bulk Delivery Options: Take advantage of bulk delivery services to streamline your fuel management and enhance efficiency.

- Support for High-Use Industries: Off-road diesel is ideal for sectors like agriculture and construction equipment, where fuel consumption is high.

- Reallocated Resources: With savings on fuel, you can allocate funds to other operational needs, improving overall business performance.

Compliance and Regulatory Importance

Maneuvering the complexities of compliance and regulation is essential for businesses using off-road diesel. You need to understand that using off-road diesel in on-road vehicles can lead to hefty penalties, reaching up to $10,000.

Since 2014, increased regulations have focused on reducing emissions from off-road diesel, achieving a remarkable 90% reduction in exhaust emissions compared to earlier standards.

Both off-road and on-road diesel now meet Ultra-Low Sulfur Diesel (ULSD) specifications, guaranteeing a similar environmental impact with a maximum sulfur content of just 15 parts per million (ppm). By adhering to these compliance requirements, your business can operate without the risk of legal repercussions while reaping the benefits of fuel cost advantages.

Off-road diesel is untaxed and can be about 25 cents cheaper per gallon than on-road diesel, making it an attractive option for industries like agriculture and construction.

Stay informed about state and federal regulations to guarantee you're using off-road diesel correctly. This not only helps you avoid penalties but also supports your bottom line and contributes to a cleaner environment.

Frequently Asked Questions

Can You Run Off-Road Diesel in a Regular Diesel?

You can't run off-road diesel in a regular diesel vehicle. It's illegal and could lead to hefty fines if you're caught.

Authorities can easily detect the red dye in off-road diesel, making it risky for you. Plus, using it might damage your vehicle's fuel system due to the higher sulfur content, leading to costly repairs.

Stick to regular diesel to avoid legal issues and keep your vehicle running smoothly.

Why Can't I Use Off-Road Diesel?

You wouldn't want to get caught using off-road diesel, right?

It's illegal for on-road vehicles because it's tax-exempt and meant only for machinery in agriculture and construction. If you do use it, you risk hefty fines—up to $10,000 in some places!

Plus, that distinct red dye can lead to scrutiny from authorities.

Stick to regular diesel to avoid legal trouble and keep your vehicle compliant with emissions standards.

Is It Illegal to Use Off-Road Diesel?

Yes, it's illegal to use off-road diesel in on-road vehicles.

This type of diesel is marked with a red dye to indicate its tax-exempt status, and law enforcement actively checks for this dye.

If you're caught using it in a vehicle meant for public roads, you could face hefty fines, inspections, and even criminal charges.

Stick to on-road diesel to avoid these serious legal repercussions and verify compliance with federal regulations.

Why Is Off-Road Diesel the Same Price as Regular Diesel?

You might wonder why off-road diesel costs the same as regular diesel sometimes.

While off-road diesel usually has a price advantage due to its tax-exempt status, market fluctuations can equalize costs.

Factors like supply chain issues, local demand, and distribution methods can influence pricing.

Additionally, some states may have higher taxes on on-road diesel, making it less predictable.

Conclusion

In conclusion, while both off-road and regular diesel fuel serve essential roles, their differences in taxation, use, and regulations can make a world of difference. Off-road diesel is like the secret sauce for construction and agricultural machinery, offering cost savings and compliance benefits. Understanding these distinctions helps you make informed choices for your equipment. So, next time you fill up, remember: it's not just diesel; it's the fuel that powers your work and drives your success!